Why invest in VIG?

We are the leading insurance group in Central and Eastern Europe. “Protecting what matters” is our promise. More than 50 insurance companies and pension funds provide the best possible protection against the risks of day-to-day life for their customers. The Group strategy is to achieve long-term profitable growth.

2023 Key Figures

EUR

10.9

bn

Insurance service revenue

EUR

772.7

mn

Result before taxes

269

%

Solvency ratio

92.6

%

Net Combined Ratio

5.3

%*

Dividend yield

~

29,000

Employees

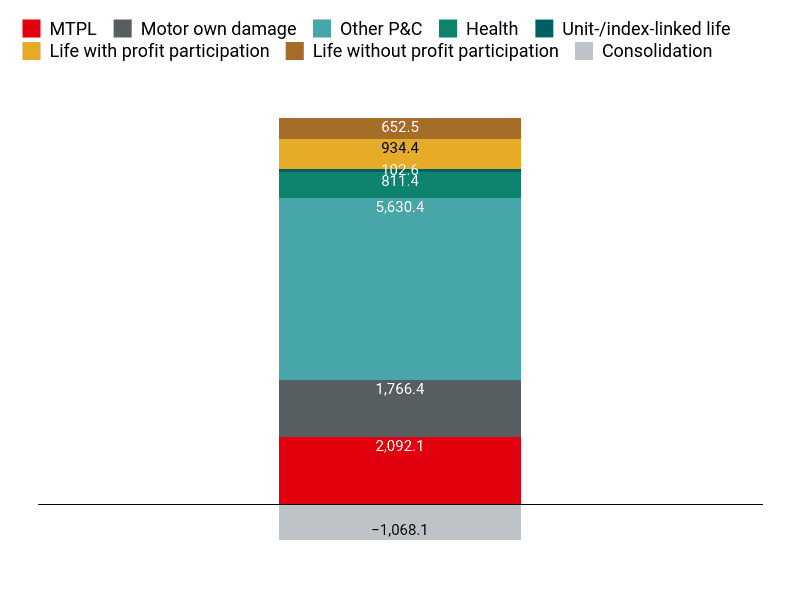

Insurance Service Revenue

by line of business 2023

in EUR mn incl. Group Functions

Investment Story

Broad portfolio with growth potential

- Insurance solutions in the property/casualty, life and health business across 30 countries

- Over 30 years of M&A experience in the CEE region

- Organic and inorganic growth initiatives to further expand VIG's leading market position

Financial stability

- “A+” rating with stable outlook from Standard & Poor’s

- Solvency ratio of 269% in 2023

- Continuous dividend distribution every year since 1994

Proven management principles ensure customer proximity

- Local entrepreneurship for taking quick, flexible action on the market

- Multi-channel distribution to exploit all sales opportunities

- Multi-brand policy to ensure broad appeal in relation to target groups

- Conservative investment and reinsurance policies create trust

Sustainability as an integral part of the business model

- Sustainability program with a focus on six spheres of impact: Investments, underwriting, operations, employees, customers, society

- Declarations of “Responsible Investment” and “Responsible Insurance”

AT0000908504

ISIN

Vienna,Prague,Budapest

LISTINGS

VIG

Ticker symbol

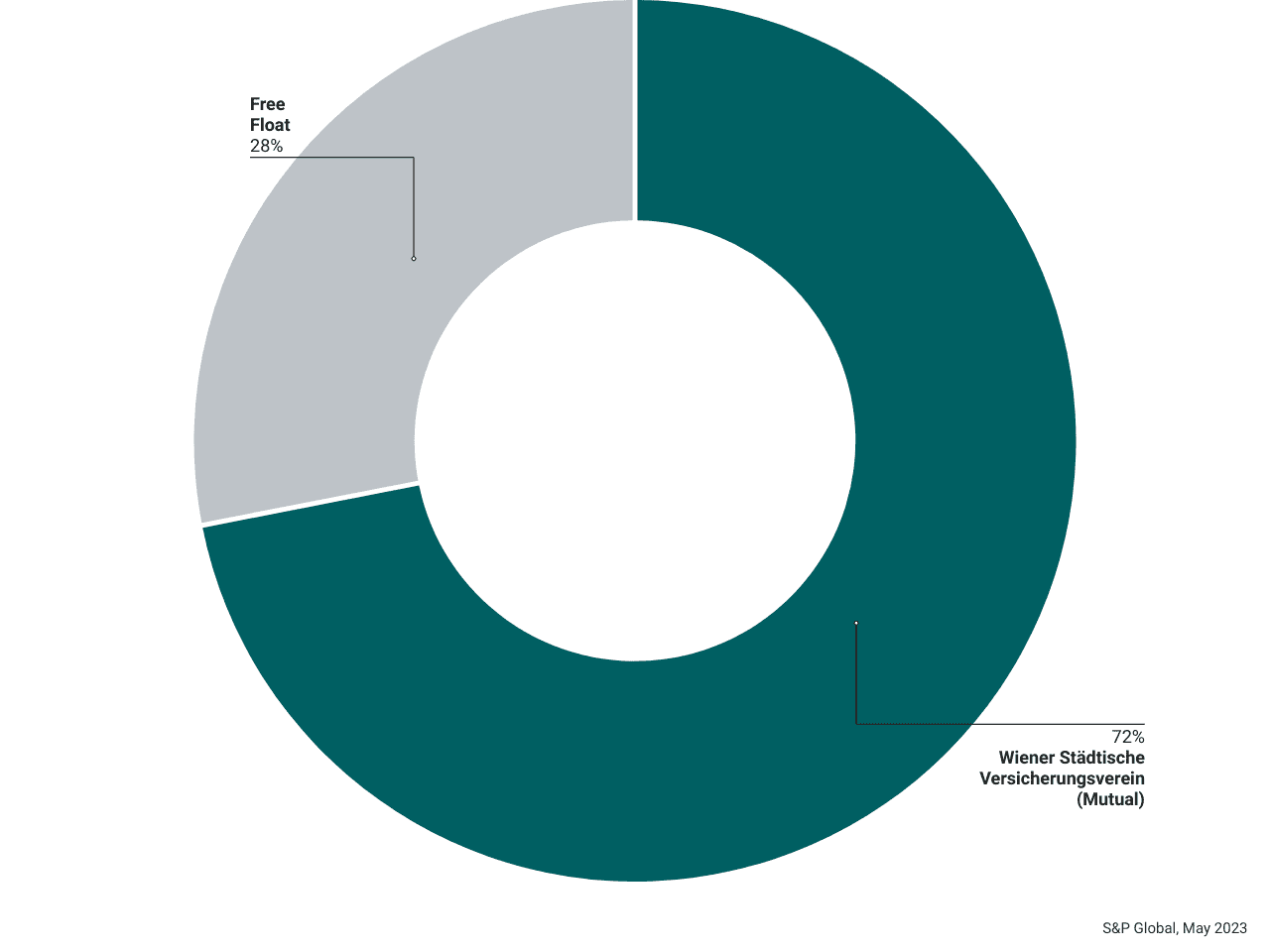

128

mn

ordinary shares

EUR

132.89

mn

share capital

EUR

3.70

bn

MARKET CAPITALISATION (31/03/2024)

The participation of shareholders in VIG's success is a priority for us, and we have paid dividends every year without interruption since 1994.

The participation of shareholders in VIG's success is a priority for us, and we have paid dividends every year without interruption since 1994.

Managing Board

Hartwig Löger

General Manager (CEO), Chairman of the Managing Board

CV Download

Peter Höfinger

Deputy General Manager, Deputy Chairman of the Managing Board

CV Download

Liane Hirner

Member of the Managing Board, Chief Finance and Risk Officer (CFRO)

CV Download

Gerhard Lahner

Member of the Managing Board, Chief Operations Officer (COO)

CV Download

Gábor Lehel

Member of the Managing Board, Chief Innovation Officer (CIO)

CV Download

Harald Riener

Member of the Managing Board

CV Download

Key figures table

Key Figures of Vienna Insurance Group

| Income statement |

2023

|

2022 adjusted |

||

|

Calculation differences may arise when rounded amounts and percentages are summed automatically. 1 Gross written premiums are not part of IFRS 17/9 reporting 2 The calculation of this figure considers the interest expenses for hybrid capital. |

||||

| Gross written premiums1 | EUR million | 13,784.0 | 12,559.2 | |

| Insurance service revenue | EUR million | 10,921.8 | 9,737.6 | |

| Total capital investment result | EUR million | 284.3 | -12.2 | |

| Result before taxes | EUR million | 772.7 | 585.7 | |

| Net result of the period after taxes and non-controlling interests | EUR million | 559.0 | 472.3 | |

| Earnings per share2 | EUR | 4.31 | 3.63 | |

| Net Combined Ratio (P&C) | % | 92.6 | 92.8 | |

| Balance sheet | ||||

| Total capital investment portfolio | EUR million | 42,586.1 | 41,062.2 | |

| Insurance contracts liabilities issued | EUR million | 37,804.1 | 36,370.4 | |

| Consolidated shareholders' equity (incl. non-controlling interests) | EUR million | 6,029.7 | 5,713.9 | |

| Contractual Service Margin (CSM) | EUR million | 5,797.2 | 5,838.1 | |

| Total assets | EUR million | 48,753.8 | 47,217.7 | |

| Operating Return on Equity (Operating RoE) | % | 15.1 | 11.6 | |

| Solvency Ratio | % | 269 | 280 | |

IR Calendar

Contact

IR Contact

Investor Relations VIENNA INSURANCE GROUP AG

+43 (0) 50 390 - 21919

Send e-mail

investor.relations@vig.com

Make an appointment

VIG IR on LinkedIn

Related links